The business entity must: File the appropriate dissolution, surrender, or cancellation form (s) with the SOS within 12 months of filing the final tax return. If the business entity is suspended or forfeited, it will need to go through the revivor process and be in good standing before being allowed to dissolve, surrender, or cancel. To revive a

California Corporation Search (Guide: All You Need To Know)

Jul 8, 2022The State of California Franchise Tax Board (FTB) requires that prior to dissolving a business, the entity must file all delinquent tax returns and pay all tax balances, including any penalties, fees and interest. It must also file a final tax return expressly indicating on the form that it is a final return and cease transacting business in

Source Image: shopify.com

Download Image

1. Board Meeting and Vote. When a business owner decides to end operations and shut down his or her corporation in California, the first thing they should do is to hold a Board of Directors meeting. This a formal meeting during which the owner will submit a motion to dissolve the corporation.

Source Image: riteaid.com

Download Image

My corporation is inactive and I would like to dissolve it, what should I be aware of? – Madan CA FOLLOW THESE STEPS TO DISSOLVE A COMPANY. California law requires corporation owners to complete a multi-step dissolution process: Hold a board meeting and a vote: A corporation’s board of directors must vote to dissolve the business. Though the board may already be aware of the reasons for dissolution, a formal motion must be made which

Source Image: enlightenbodhi.com

Download Image

How To Dissolve A Corporation In California

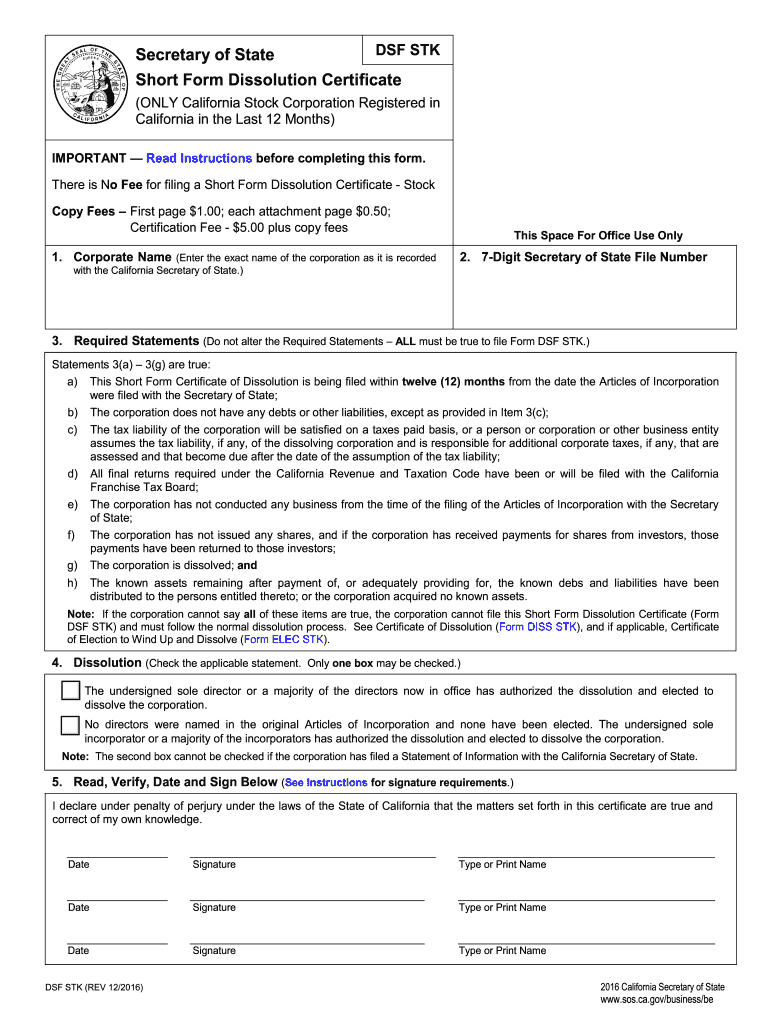

FOLLOW THESE STEPS TO DISSOLVE A COMPANY. California law requires corporation owners to complete a multi-step dissolution process: Hold a board meeting and a vote: A corporation’s board of directors must vote to dissolve the business. Though the board may already be aware of the reasons for dissolution, a formal motion must be made which To dissolve a California corporation, submit the appropriate form(s) to the California Secretary of State (SOS) by mail or in person. The dissolution forms are available on the SOS website and can be filled in online then printed out. You may type on the forms or write in black or blue ink. Checks should be payable to the Secretary of State.

Exfoliant Ingredients: 4 Most Common Types Explained — Enlighten Bodhi Spa

Here are the initial requirements for dissolving a Corporation in California: File all delinquent tax returns and pay all state tax balances, including any penalties, fees, and interest to the California Franchise Tax Board. File the final/current year tax return. Must cease doing or transacting business in California after the final taxable year. The Ultimate Guide to Tea Preparation | Tea Forte

Source Image: teaforte.com

Download Image

How a California startup aims to prove it could launch orbital rockets on a daily basis | PBS NewsHour Here are the initial requirements for dissolving a Corporation in California: File all delinquent tax returns and pay all state tax balances, including any penalties, fees, and interest to the California Franchise Tax Board. File the final/current year tax return. Must cease doing or transacting business in California after the final taxable year.

Source Image: pbs.org

Download Image

California Corporation Search (Guide: All You Need To Know) The business entity must: File the appropriate dissolution, surrender, or cancellation form (s) with the SOS within 12 months of filing the final tax return. If the business entity is suspended or forfeited, it will need to go through the revivor process and be in good standing before being allowed to dissolve, surrender, or cancel. To revive a

Source Image: incorporated.zone

Download Image

My corporation is inactive and I would like to dissolve it, what should I be aware of? – Madan CA 1. Board Meeting and Vote. When a business owner decides to end operations and shut down his or her corporation in California, the first thing they should do is to hold a Board of Directors meeting. This a formal meeting during which the owner will submit a motion to dissolve the corporation.

Source Image: madanca.com

Download Image

Can an Accountant Practice Accountancy Using a California LLC? – San Diego Corporate Law Dec 13, 2023Step 3: Compliance with State Regulations: Dissolving a corporation involves adhering to state regulations. This often includes filing dissolution documents with the Secretary of State or equivalent regulatory body. In addition to the Certificate of Dissolution, California also requires a written document called a Certificate of Election which

Source Image: sdcorporatelaw.com

Download Image

Certificate of dissolution california: Fill out & sign online | DocHub FOLLOW THESE STEPS TO DISSOLVE A COMPANY. California law requires corporation owners to complete a multi-step dissolution process: Hold a board meeting and a vote: A corporation’s board of directors must vote to dissolve the business. Though the board may already be aware of the reasons for dissolution, a formal motion must be made which

Source Image: dochub.com

Download Image

Consequences of Forgetting to File California’s Statement of Information — Jonathan Grissom, Nonprofit Attorney To dissolve a California corporation, submit the appropriate form(s) to the California Secretary of State (SOS) by mail or in person. The dissolution forms are available on the SOS website and can be filled in online then printed out. You may type on the forms or write in black or blue ink. Checks should be payable to the Secretary of State.

Source Image: californianonprofitlaw.com

Download Image

How a California startup aims to prove it could launch orbital rockets on a daily basis | PBS NewsHour

Consequences of Forgetting to File California’s Statement of Information — Jonathan Grissom, Nonprofit Attorney Jul 8, 2022The State of California Franchise Tax Board (FTB) requires that prior to dissolving a business, the entity must file all delinquent tax returns and pay all tax balances, including any penalties, fees and interest. It must also file a final tax return expressly indicating on the form that it is a final return and cease transacting business in

My corporation is inactive and I would like to dissolve it, what should I be aware of? – Madan CA Certificate of dissolution california: Fill out & sign online | DocHub Dec 13, 2023Step 3: Compliance with State Regulations: Dissolving a corporation involves adhering to state regulations. This often includes filing dissolution documents with the Secretary of State or equivalent regulatory body. In addition to the Certificate of Dissolution, California also requires a written document called a Certificate of Election which