Feb 27, 2023Check out LLC taxed as Sole Proprietorship for more details. To start an LLC in California, you need to file the Certificate of Formation with the Secretary of State and pay a $200 filing fee. A Limited Liability Company must also pay an LLC annual fee and appoint a Registered Agent in order to stay in compliance.

How to Start a Sole Proprietorship in California – Formations

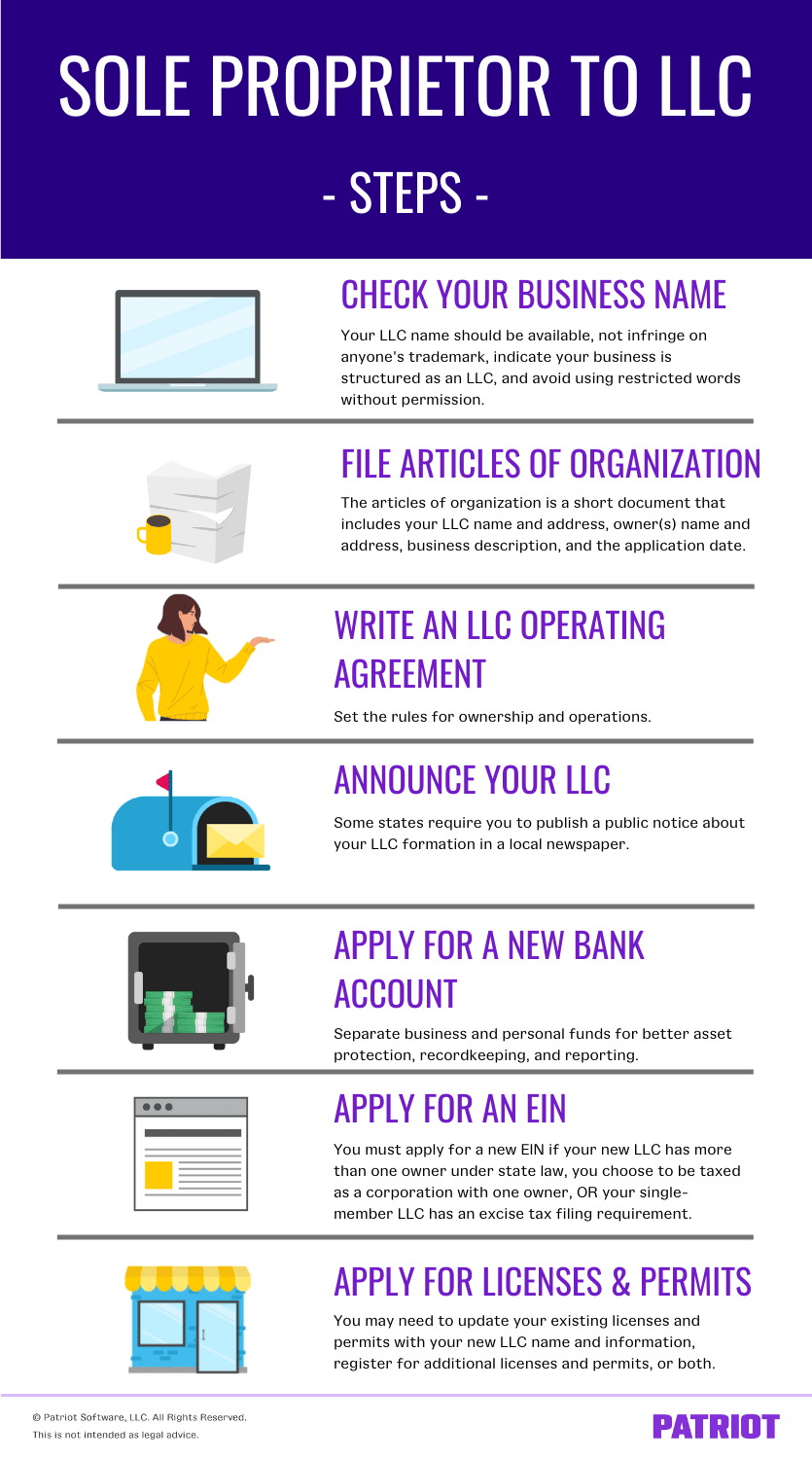

Dec 26, 2023Sole Proprietorship Disadvantages. Steps to Start a Sole Proprietorship in California. Step 1: Come Up With a Business Name. Step 2: File the Fictitious Business Name Statment Form. Step 3: Get an EIN. Step 4: Research Business License Requirements.

Source Image: pinterest.com

Download Image

A sole proprietorship is simply a Business-of-One. One owner, you, who gets all the assets and profits and takes responsibility for the taxes. It’s the most common way to structure a business if you’re a freelancer, consultant or small business offering services to clients. But it’s not always the best business structure.

Source Image: patriotsoftware.com

Download Image

17 Advanced Ecommerce Link Building Tactics to Drive Traffic in 2023 Sole proprietorships involve less paperwork. Cost: Forming and maintaining an LLC has higher upfront fees and ongoing costs. Useful resources to help start your sole proprietorship in California. California Secretary of State; US Patent and Trademark Office; California County contact details EIN application Personal tax form 1040; Schedule C

Source Image: sketchdesignrepeat.com

Download Image

How To Form A Sole Proprietorship In California

Sole proprietorships involve less paperwork. Cost: Forming and maintaining an LLC has higher upfront fees and ongoing costs. Useful resources to help start your sole proprietorship in California. California Secretary of State; US Patent and Trademark Office; California County contact details EIN application Personal tax form 1040; Schedule C Looking for an easy step-by-step guide to show you exactly how to start your business simply in the state of California as a sole proprietor? I’m sharing the

5 Steps to Set Up Your Surface Design Business – Sketch Design Repeat

In this video I share the 9 steps to set up your sole proprietorship small business in Calif… Are you looking to start your one-person business in California? In this video I share the 9 steps 6 Steps to Start a Sole Proprietorship in California | Open a One-Person Sole Proprietor Business – YouTube

Source Image: m.youtube.com

Download Image

How to form a Sole Proprietorship Business || Becoming a Sole Proprietor – YouTube In this video I share the 9 steps to set up your sole proprietorship small business in Calif… Are you looking to start your one-person business in California? In this video I share the 9 steps

Source Image: m.youtube.com

Download Image

How to Start a Sole Proprietorship in California – Formations Feb 27, 2023Check out LLC taxed as Sole Proprietorship for more details. To start an LLC in California, you need to file the Certificate of Formation with the Secretary of State and pay a $200 filing fee. A Limited Liability Company must also pay an LLC annual fee and appoint a Registered Agent in order to stay in compliance.

Source Image: formationscorp.com

Download Image

17 Advanced Ecommerce Link Building Tactics to Drive Traffic in 2023 A sole proprietorship is simply a Business-of-One. One owner, you, who gets all the assets and profits and takes responsibility for the taxes. It’s the most common way to structure a business if you’re a freelancer, consultant or small business offering services to clients. But it’s not always the best business structure.

Source Image: vazoola.com

Download Image

How to File Sole Proprietorship Taxes (with Pictures) – wikiHow Life Obtain An Employer Identification Number (EIN) 1. Choose A Business Name. In California, a sole proprietor has the option to use either their legal name or a trade name, also referred to as a “fictitious business name” (FBN) or “doing business as” (DBA), for conducting their business. However, if you decide to use an FBN or trade name

Source Image: wikihow.life

Download Image

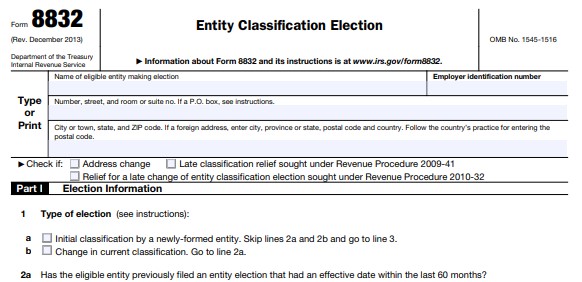

IRS Form 8832 Instructions & FAQs Sole proprietorships involve less paperwork. Cost: Forming and maintaining an LLC has higher upfront fees and ongoing costs. Useful resources to help start your sole proprietorship in California. California Secretary of State; US Patent and Trademark Office; California County contact details EIN application Personal tax form 1040; Schedule C

Source Image: fitsmallbusiness.com

Download Image

How to start a Sole Proprietorship in California – 2024 Guide Looking for an easy step-by-step guide to show you exactly how to start your business simply in the state of California as a sole proprietor? I’m sharing the

Source Image: llcuniversity.com

Download Image

How to form a Sole Proprietorship Business || Becoming a Sole Proprietor – YouTube

How to start a Sole Proprietorship in California – 2024 Guide Dec 26, 2023Sole Proprietorship Disadvantages. Steps to Start a Sole Proprietorship in California. Step 1: Come Up With a Business Name. Step 2: File the Fictitious Business Name Statment Form. Step 3: Get an EIN. Step 4: Research Business License Requirements.

17 Advanced Ecommerce Link Building Tactics to Drive Traffic in 2023 IRS Form 8832 Instructions & FAQs Obtain An Employer Identification Number (EIN) 1. Choose A Business Name. In California, a sole proprietor has the option to use either their legal name or a trade name, also referred to as a “fictitious business name” (FBN) or “doing business as” (DBA), for conducting their business. However, if you decide to use an FBN or trade name